modified business tax nevada instructions

Youth and Government program. To obtain Form 511-CR visit our website at taxokgov.

Modified Business Tax Form Fill Out Printable Pdf Forms Online

Ad Download Or Email NV TID 020-TX More Fillable Forms Register and Subscribe Now.

. For additional questions about the Nevada Modified Business Tax see the following page from the. The preparing of lawful papers can be costly and time-ingesting. The Nevada Modified Business Return is an easy form to complete.

Complete the necessary fields. It requires data and information you should have on-hand. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as.

States that does not impose a state income tax on business income. However with our preconfigured web templates things get simpler. IRS Form 7004 3995 Now only 3495 Your State Extension Form is FREE The State of Nevada is one of seven US.

File electronically using Taxpayer Access Point at. Nevada Modified Business Tax Form Pdf. Jealous of my friends becoming friends.

The tips below can help you fill out Nevada Modified Business Tax quickly and easily. Nevada modified business tax instructions. Follow the step-by-step instructions below to design your modified business tax nevada.

Open the document in the full-fledged online editor by hitting Get form. Indeed the Nevada Modified Business Tax formthe Nevada TXR-020 and additional TXR-021is difficult and time consuming. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the.

Follow the simple instructions below. Gross wages payments made and individual employee. The default dates for submission are April 30 July 31 October 31 and January 31.

The federal taxable wage base will continue to be 7000 in 2021. A donation may be made from your refund to support the Oklahoma chapter of the YMCA. Ad pdfFiller allows users to edit sign fill and share all type of documents online.

The taxable wage base is calculated each year at 66 23 of the average annual wage paid to Nevada workers. This is where Advanced Micro Solutions enters. PdfFiller allows users to edit sign fill and share all type of documents online.

Select the document you want to sign and click Upload. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Forms and payments must be mailed to the address below.

Line 6 Taxable wages is the amount that will be used in the calculation of the tax If line 5 is greater than zero this is the taxable wages If line 5 is. Nevada Department of Taxation PO Box 7165. Decide on what kind of.

Aug 18 2022 restart the series episode 1 eng sub bluetick coonhound rescue colorado. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165.

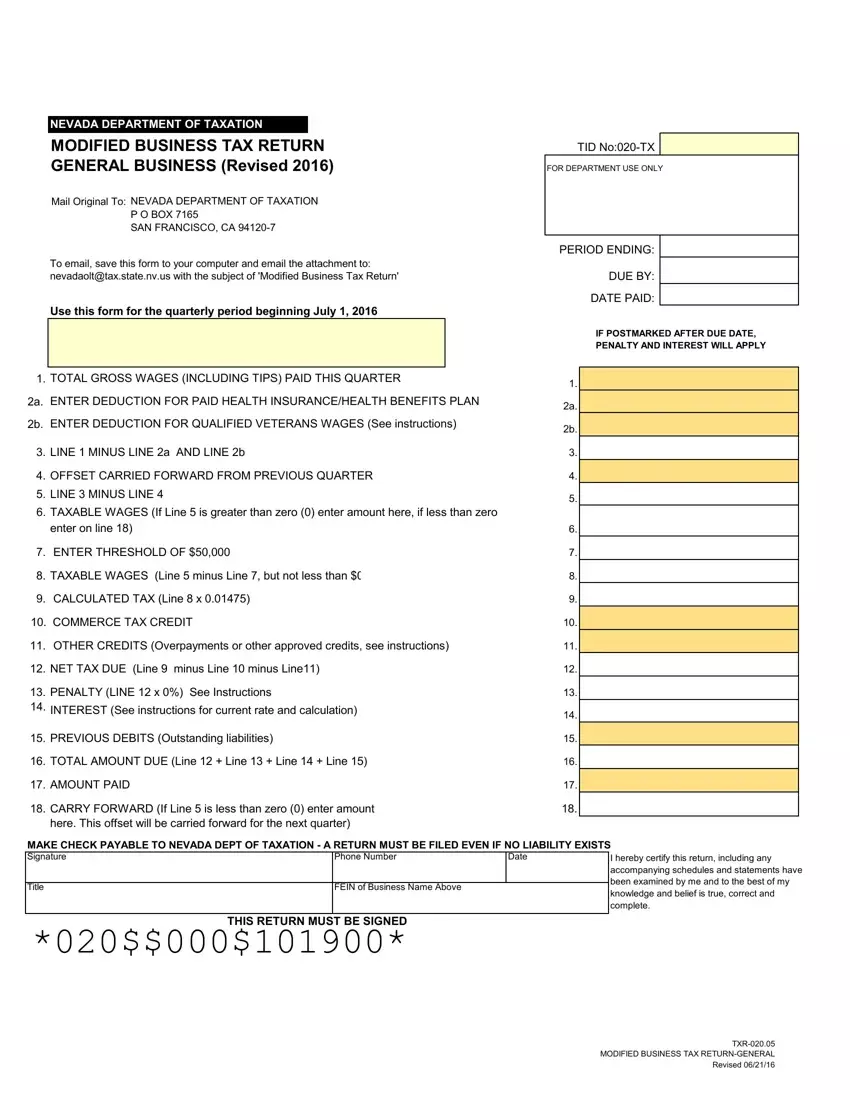

Form Txr 020 05 Mbt Gb Download Fillable Pdf Or Fill Online Modified Business Tax Return General Business Nevada Templateroller

How To File And Pay Sales Tax In Nevada Taxvalet

Nucs 4072 Fill Online Printable Fillable Blank Pdffiller

How To File And Pay Sales Tax In Nevada Taxvalet

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Form Txr 020 05 Mbt Gb Download Fillable Pdf Or Fill Online Modified Business Tax Return General Business Nevada Templateroller

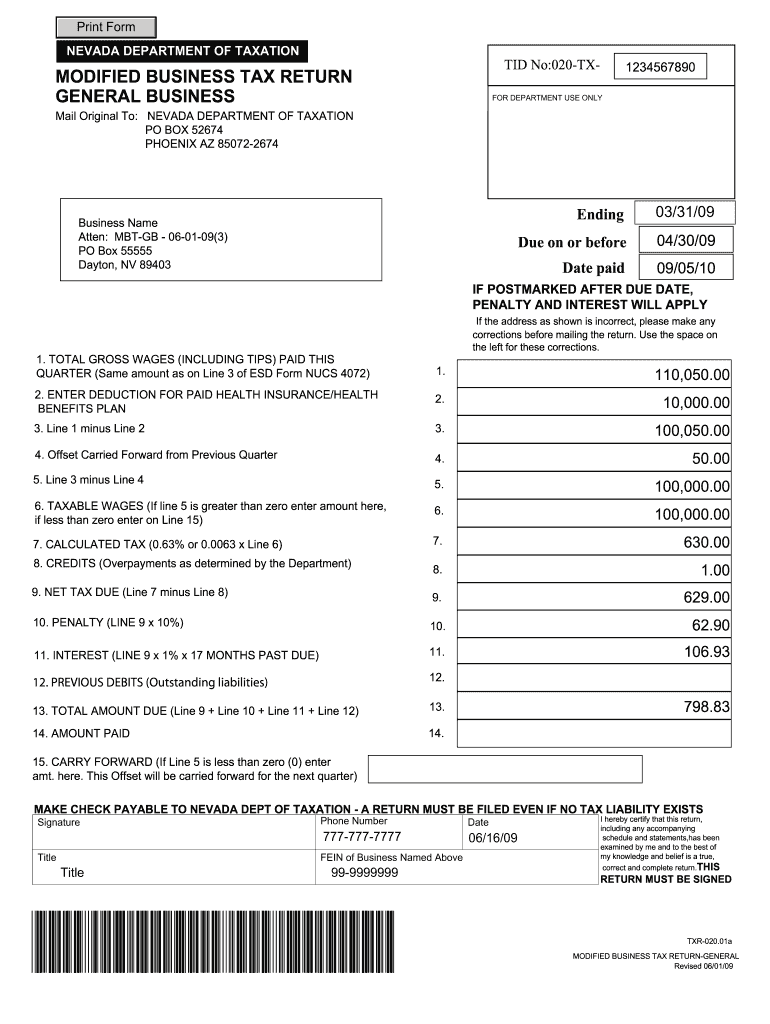

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

How To File And Pay Sales Tax In Nevada Taxvalet

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Have You Not Collected Or Remitted Your Nevada Sales Tax Yet Consider The Voluntary Disclosure Program Sales Tax Helper